Step-by-Step Guide to Integrating a 2D Payment Gateway into Your Website

Step-by-Step Guide to Integrating a 2D Payment Gateway into Your Website

Blog Article

The Duty of a Settlement Portal in Streamlining Shopping Settlements and Enhancing User Experience

The combination of a payment portal is essential in the ecommerce landscape, serving as a safe and secure channel in between consumers and sellers. By enabling real-time deal processing and sustaining a selection of repayment approaches, these entrances not only alleviate cart desertion however additionally improve total client satisfaction.

Recognizing Payment Entrances

A settlement gateway offers as a crucial intermediary in the ecommerce purchase procedure, helping with the safe and secure transfer of repayment details in between customers and vendors. 2D Payment Gateway. It allows on-line businesses to accept different kinds of payment, consisting of bank card, debit cards, and electronic wallets, therefore expanding their consumer base. The portal runs by securing delicate details, such as card information, to ensure that data is transferred safely over the net, decreasing the risk of fraudulence and information violations

When a customer initiates an acquisition, the settlement gateway catches and forwards the deal information to the proper banks for authorization. This process is usually smooth and happens within seconds, supplying clients with a fluid purchasing experience. Repayment gateways play an essential duty in compliance with industry standards, such as PCI DSS (Repayment Card Sector Information Protection Criterion), which mandates stringent safety procedures for refining card repayments.

Comprehending the mechanics of settlement portals is important for both sellers and customers, as it directly affects deal effectiveness and consumer count on. By ensuring efficient and safe and secure deals, repayment gateways add substantially to the overall success of shopping services in today's digital landscape.

Secret Features of Repayment Portals

A number of key attributes define the performance of repayment gateways in ecommerce, ensuring both safety and convenience for individuals. One of one of the most essential features is durable security protocols, consisting of security and tokenization, which safeguard delicate customer data throughout transactions. This is necessary in fostering trust between merchants and consumers.

In addition, real-time deal processing is essential for guaranteeing that payments are finished quickly, reducing cart desertion rates. Payment portals additionally provide fraud discovery tools, which check deals for suspicious activity, further securing both consumers and sellers.

Benefits for E-Commerce Organizations

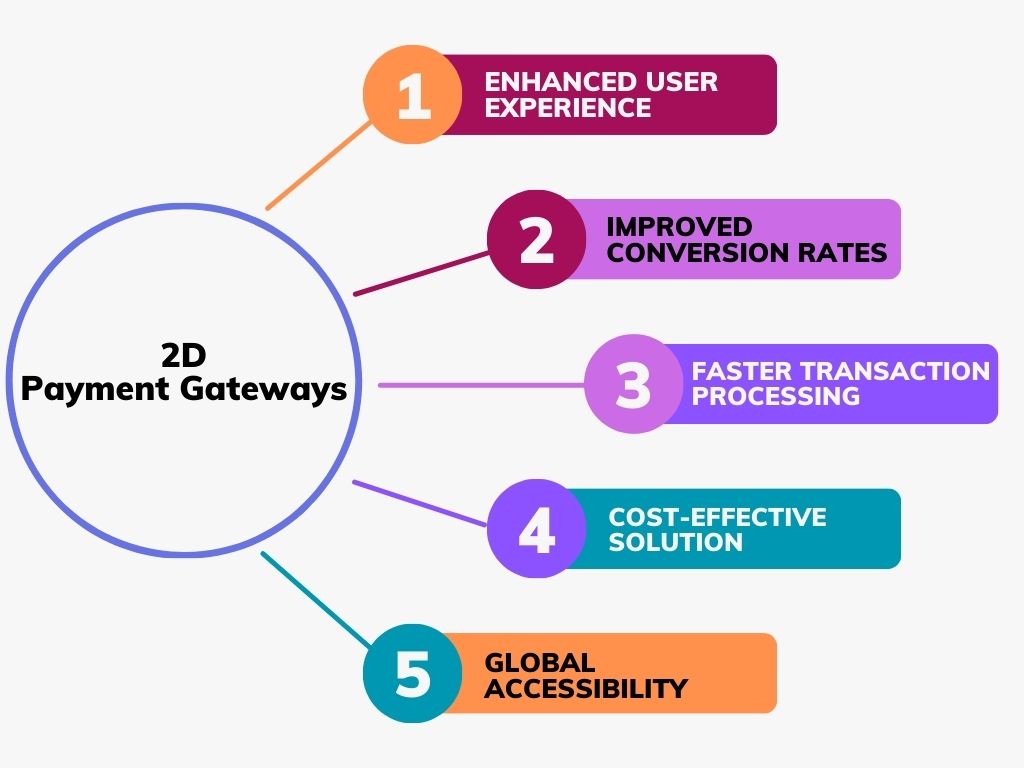

Various advantages occur from incorporating repayment portals right into ecommerce businesses, significantly improving functional effectiveness and customer complete satisfaction. Payment entrances facilitate seamless purchases by safely processing repayments in real-time. This capacity minimizes the probability of cart desertion, as customers can promptly complete their purchases without unneeded hold-ups.

Moreover, payment entrances support numerous payment methods, fitting a varied array of customer preferences. This adaptability not just attracts a wider client base yet additionally fosters loyalty amongst existing clients, as they feel valued when used their recommended settlement alternatives.

Furthermore, the combination of a payment portal usually causes improved safety and security attributes, such as security and scams detection. These procedures safeguard sensitive client information, thus building trust fund and reputation for the ecommerce brand name.

Moreover, automating payment procedures via gateways reduces manual work for staff, enabling them to concentrate on calculated initiatives instead of routine jobs. This functional effectiveness converts into price savings and enhanced source allowance.

Enhancing Customer Experience

Integrating a reliable repayment gateway is critical for enhancing individual experience in shopping. A reliable and the original source smooth payment process not just constructs consumer count on yet also lessens cart abandonment rates. By supplying numerous payment options, such as bank card, electronic pocketbooks, and bank transfers, services satisfy varied customer preferences, thus boosting fulfillment.

Furthermore, an easy to use user interface is crucial. Payment gateways that provide user-friendly navigation and clear guidelines enable customers to complete deals quickly and effortlessly. This ease of use is important, particularly for mobile buyers, that require enhanced experiences tailored to smaller screens.

Safety functions play a significant function in individual experience also. Advanced encryption and fraud discovery devices comfort consumers that their delicate data is safeguarded, fostering confidence in the purchase procedure. Furthermore, transparent interaction concerning charges and policies improves reputation and lowers possible stress.

Future Fads in Repayment Processing

As shopping continues to evolve, so do the technologies and trends shaping settlement processing (2D Payment Gateway). The future of payment handling is marked by several transformative trends that guarantee to enhance performance and individual complete satisfaction. One significant pattern is the increase of man-made knowledge (AI) and artificial intelligence, which are being significantly integrated into repayment gateways to boost safety and security click for info via advanced fraudulence discovery and danger assessment

Furthermore, the adoption of cryptocurrencies is acquiring grip, with more services checking out blockchain innovation as a sensible choice to standard settlement methods. This change not only supplies lower deal costs but likewise interest an expanding demographic that worths decentralization and personal privacy.

Mobile wallets and contactless repayments are coming to be mainstream, driven by the demand for much faster, much more hassle-free purchase methods. This pattern is additional sustained by the increasing occurrence of NFC-enabled gadgets, making it possible for seamless transactions with just a tap.

Finally, the emphasis on regulative conformity and information defense will certainly form settlement handling strategies, as services aim to develop count on with consumers while adhering to progressing legal frameworks. These trends collectively indicate a future where payment processing is not only faster and more protected but also much more Click Here aligned with consumer expectations.

Verdict

In final thought, payment entrances offer as vital elements in the shopping ecosystem, promoting efficient and safe purchase processing. By providing varied settlement options and prioritizing individual experience, these entrances significantly decrease cart abandonment and improve customer satisfaction. The ongoing development of repayment innovations and protection measures will even more reinforce their duty, guaranteeing that shopping organizations can meet the demands of increasingly innovative consumers while fostering count on and integrity in on-line purchases.

By making it possible for real-time purchase handling and supporting a range of payment methods, these portals not only reduce cart abandonment but also enhance overall customer satisfaction.A payment gateway offers as a crucial intermediary in the e-commerce transaction procedure, promoting the safe and secure transfer of settlement info between sellers and consumers. Repayment entrances play a pivotal duty in conformity with market standards, such as PCI DSS (Settlement Card Market Information Protection Criterion), which mandates stringent security measures for refining card repayments.

A versatile repayment entrance accommodates credit score and debit cards, digital wallets, and alternate repayment methods, providing to diverse client preferences - 2D Payment Gateway. Settlement gateways promote seamless purchases by securely refining payments in real-time

Report this page